In the year 2023, the French wine and spirits sector navigated through challenging waters to post exports worth €16.2 billion. Despite representing a 5.9% decline from the previous year, this figure stands as the second-highest in the industry’s export history. The volume of exports also saw a considerable reduction, falling by 10.4%. However, the sector managed to maintain its status as the leading contributor to France’s agri-food surplus and the third largest in the nation’s overall trade balance, with a trade surplus of €14.8 billion, down by 5.8%.

The backdrop of 2023 was fraught with global uncertainties, including persistent international tensions and notable inflationary pressures. Gabriel Picard, President of the French Association of Wine and Spirits Exporters (FEVS), highlighted the resilience of the sector amidst these adversities, underscoring the achievement of the second-best export figure in the face of significant challenges.

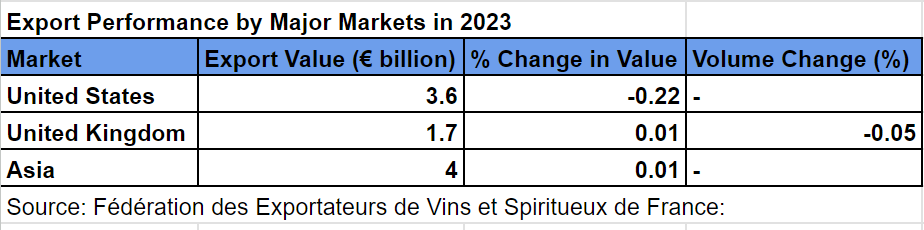

A closer look at the export markets reveals a mixed picture. In the United States, the sector experienced a notable decline, with exports decreasing by 22% to €3.6 billion. This downturn was primarily attributed to wholesalers’ efforts to diminish stockpiles accumulated during the Covid-19 pandemic, coupled with subsequent logistical challenges. The decline was particularly sharp in the spirits category, which plummeted by 37%, and sparkling wines, which fell by 16%. Still, wines managed to hold their ground, maintaining stable value. Towards the end of 2023, however, there were signs of a potential recovery in this crucial market.

Different Markets, Different Outcomes

The United Kingdom presented a more stable environment, with a modest 1% increase in export value to €1.7 billion. The market for sparkling and still wines remained largely unchanged in terms of sales, despite a 5% drop in volumes. Spirits showed a slight increase in value (+2%) while experiencing a minimal volume decrease (-1%).

In the Asian Market the trend was similarly mixed, with overall exports standing at €4 billion, marking a 1% increase. Japan saw a 4% decrease, while South Korea and Taiwan remained stable. China offered a varied scenario, with spirits, particularly Cognac, showing a 3% growth, contrasting with a 20% fall in wine value, reflecting the broader decline in Chinese wine imports by 21%. Emerging markets like Malaysia and the Philippines showed significant growth, albeit from a smaller base, with increases of 20% and 74% respectively, totaling €100 million for both countries.

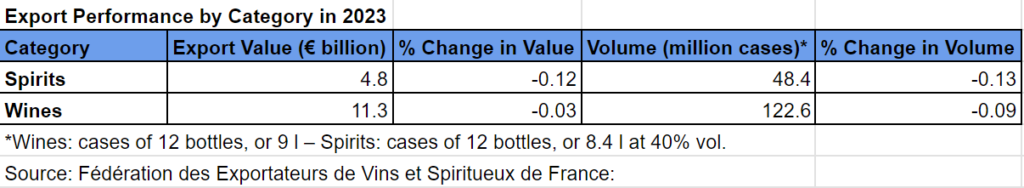

The global sales of French spirits were particularly hard-hit, decreasing by 12% to €4.8 billion, with a 13% fall in volume. Wine exports fared slightly better, decreasing by 3% to €11.3 billion, with volumes down by 9.4%.

Global Challenges

icard pointed out that the sector’s challenges in 2023 were exacerbated by high inflation and a dip in consumption due to reduced disposable incomes. The contraction in exports, especially in volume, was partly due to efforts to reduce overstocks in several markets, notably the US.

The downturn in 2023 serves as a critical reminder for exporters of the need to remain agile and responsive to evolving consumer and market dynamics. Picard emphasized the importance of continued support from public authorities to sustain the export success of French wines and spirits. This includes opening up new markets and safeguarding existing ones against potential trade retaliatory measures. He argued that the strength of France’s export sector contributes to the nation’s sovereignty, underscoring the significance of maintaining a global presence for the wine and spirits industry.

In conclusion, while 2023 marked a period of adjustment for the French wine and spirits sector, it also highlighted the industry’s resilience and the ongoing importance of strategic adaptation. The FEVS’s analysis provides a comprehensive overview of the challenges and opportunities facing exporters, offering insights into the paths forward in a rapidly changing global landscape. As the sector looks to rebound from the soft landing of 2023, the emphasis on market diversification, responsiveness to consumer trends, and robust support mechanisms will be crucial for sustaining and enhancing France’s prestigious position in the global wine and spirits market.

Overview Performances

Market-Specific Performance Highlights in 2023

United States

- Spirits: -37%

- Sparkling wines: -16%

- Still wines: Stable

United Kingdom

- Sparkling and still wines: Unchanged value

- Spirits: Value +2%, Volume -1%

Asia

- Japan: -4%

- China: Spirits +3%, Wines -20%

- Malaysia: +20%

- Philippines: +74%

Thanks for Reading!

Glad you dropped by! If the insights here struck a chord, why not share them? And if you’re eager to talk more, I’m all ears – just reach out. Looking for someone to spark inspiration in your masterclass or brand event? Let’s talk and set up something amazing.

Disclaimer

This text was neither commissioned nor compensated. It reflects exclusively my own opinion.

Source: FEVS Press Release – 2023 Wine & Spirits Export figures Report

ConVINOsation Podcast Brings EUROVINO Wine Fair to Life

In collaboration with Messe Karlsruhe, we are proud to launch ConVINOsation, a new podcast dedicated to tackling the wine industry’s most pressing topics. Hosted by

Live on Wein Verkauft!

I recently had the opportunity to join freelance consultant Diego Weber from Germany on his podcast, On German!. Over the course of the two-hour episode,

Live on the Morning Show

In July 2024, I had the exciting opportunity to appear on New York’s WTBQ Frank Truatt’s Morning Show, the #1 drive time morning show, with

Challenging Year for French Wines & Spirits Exports 2023

In the year 2023, the French wine and spirits sector navigated through challenging waters to post exports worth €16.2 billion. Despite representing a 5.9% decline from the previous year, this figure stands as the second-highest in the industry’s export history. The volume of exports also saw a considerable reduction, falling by 10.4%. However, the sector managed to maintain its status as the leading contributor to France’s agri-food surplus and the third largest in the nation’s overall trade balance, with a trade surplus of €14.8 billion, down by 5.8%.

DWI Announces Winner of the Sommelier Cup 2024

The DWI Sommelier-Cup 2024, hosted by the German Wine Institute (DWI), concluded on January 22, 2024, with Katharina Iglesias from wineBank in Hamburg claiming the title. The event, held at the Atrium Hotel in Mainz, witnessed participation from 28 professionals across various sectors of the wine industry. While the competition’s popularity remains undeniable, a critical examination of its structure and outcomes reveals aspects worth contemplating.

German Wine Consumption Plummets in 2023

The German wine consumption and buying behaviour is changing. (Photo: DallE)